Not known Factual Statements About Do I Have To List All My Assets and Debts When Filing Bankruptcy?

Each individual post that we publish has long been composed or reviewed by one among our editors, who with each other have around 100 a long time of practical experience practicing regulation. We strive to maintain our info latest as laws transform. Find out more about our editorial criteria.

If that is definitely unsuccessful, test calling the courtroom that taken care of the lawsuit to receive extra specifics of who sued you and the small print of the case.. Courts also have online databases.

Launched in 1976, Bankrate has a long background of encouraging people make good economical possibilities. We’ve maintained this popularity for more than four decades by demystifying the monetary decision-producing method and supplying folks self-assurance wherein steps to choose subsequent. Bankrate follows a rigorous editorial plan, so you can have faith in that we’re Placing your pursuits 1st.

Serious house. Authentic house consists of land and improvements or properties tied to land, like a residence or barn.

As opposed to acquiring multiple credit card charges and various accounts to pay, usually with incredibly substantial fascination premiums, credit card debt consolidation minimizes those person debts into a single payment on a monthly basis.

In the situation of a house house loan, phone your bank loan servicer to view what possibilities might be available to you. Some lenders provide alternatives like:

A go to this site lot of people retain packing containers of aged bills, and we know it might be intimidating to search by means of them. Obtaining the names of hospitals or other medical providers official statement to ensure you’re capable to do away with them as aspect of your bankruptcy is probably going value that Original stress and anxiety.

If you're considering filing for bankruptcy, you're not by yourself. On a yearly basis, countless 1000's of individuals file for bankruptcy on account of their frustrating credit card debt.

The law firm or regulation business you're calling is not really needed to, and should pick not to, acknowledge you for a customer. The world wide web is just not go to this site always safe and emails sent as a result of This web site could possibly be intercepted or go through by third parties.

And - whether or not most of your respective debt is erased by way of a bankruptcy filing, you'll usually still owe one hundred% within your university student bank loan credit card debt and taxes.

For more than twenty five yrs, CuraDebt has assisted people today get on top of the things they owe through a range of bankruptcy choices. You simply spend service fees when your debts are wikipedia reference taken care of, and also you'll however conserve a lot of cash.

Loan modification. The lender could also agree to alter the phrases of your respective financial loan, which include reducing your interest level for the rest in the personal loan.

It must. One among the biggest black marks in your credit score rating is having late or missed payments, and consolidating all your personal debt into just one every month payment can make it additional very likely you'll pay out on time.

State-exempt assets have a value limit. States also established limits on visit site exempted assets approximately a specific dollar volume. As an example, jewelry is definitely an exempt asset in California Should the aggregate worth is $8,725 or less.

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Catherine Bach Then & Now!

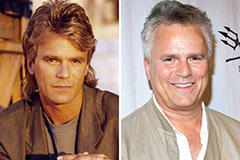

Catherine Bach Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!